,In my last post I reviewed why it appears the market will not make a quick recovery and why it may take years to get back to where we were in 2019. The downside risk that traditional stock and bond portfolios hold should be a concern for anyone, especially those planning to retire in less than 5-10 years. Even more so if you plan to retire in 1-3 years. Let’s use a real scenario to see why. If you go back to 2006, the real estate and financial markets were booming and if you were planning to retire that year or even within the next 3 years what risks would you have been exposed to, without even knowing it?

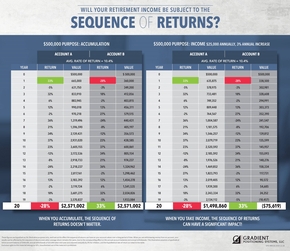

,The sequence of returns risk. If you commenced taking withdrawals from your retirement accounts and then experienced the recession that soon followed, your withdrawals would have had a catastrophic effect on the longevity of your funds. The reason behind that is that when you are in the distribution period of your life and withdrawals are taking place and the market has any negative performance you simply cannot make that up. Withdrawing dollars from a negatively performing portfolio strongly reduces the longevity of your money. The chart below illustrates the difference that returns can have when you are in the distribution phase of your life versus the accumulation phase.

,So what we are looking for here is a concept of the sequence of return. If you look closely at these portfolios, you’ll notice that the returns in portfolio A and portfolio B are identical. Except for the fact that they occur in the opposite order.

,When you’re simply accumulating money, the sequence of returns doesn’t matter. But when you start withdrawing money, it can make a significant impact on your overall experience.

,Do you really want to be subject to the sequence of returns with your retirement income?

,These risks highlight the importance of having downside protection on your retirement accounts. This is accomplished with either stop losses or some form of an insurance component to protect you from the downside, or a combination of both.

,If you would like to learn more about how to add downside protection to your accounts I would be happy to discuss this with you. ,I can be reached at 866-360-2724 or via email at barchibald@theivyag.com